How Are You Create A Motivating Story?

DRPs are thought to be a safe way set up wealth much more than a long certain period of time. However, it’s very important with regard to you to keep all of your records for tax recommend. There are many strategies to invest cash with imagination being the credit limit. Do your due diligence and research before this process.

Every day you decide to make financial decisions that impact your daily life. In order to be a thriving Invest or, you intend to make investing and saving connected with your daily routine. Many ask how to save money to use for Invest. You will be surprised how little savings it takes to begin your way to riches. Bulletins invest $20 or you’ll Invest $1000. You need to invest an amount that really feel comfortable with after every one of the bills are paid.

Every day you decide to make financial decisions that impact your daily life. In order to be a thriving Invest or, you intend to make investing and saving connected with your daily routine. Many ask how to save money to use for Invest. You will be surprised how little savings it takes to begin your way to riches. Bulletins invest $20 or you’ll Invest $1000. You need to invest an amount that really feel comfortable with after every one of the bills are paid.

The best thing is in which you can, very quickly, discover to invest your currency. It doesn’t require a four year college degree to see the world of investing. Nevertheless again, investing is not child’s play either. You only need to arm yourself with as much knowledge as you possibly. And you really should try to learn the best way to make sound investment decisions, and but not only invest founded upon a whim, based on emotion, or based on hype.

There’s an Interesting social phenomenon researchers have discovered in online friendships. People say Trading has nothing to do with Interesting but that is not entirely true. They’ve found people often change their standards of politeness and diplomacy when a conversation is going on online, versus face-to-face.

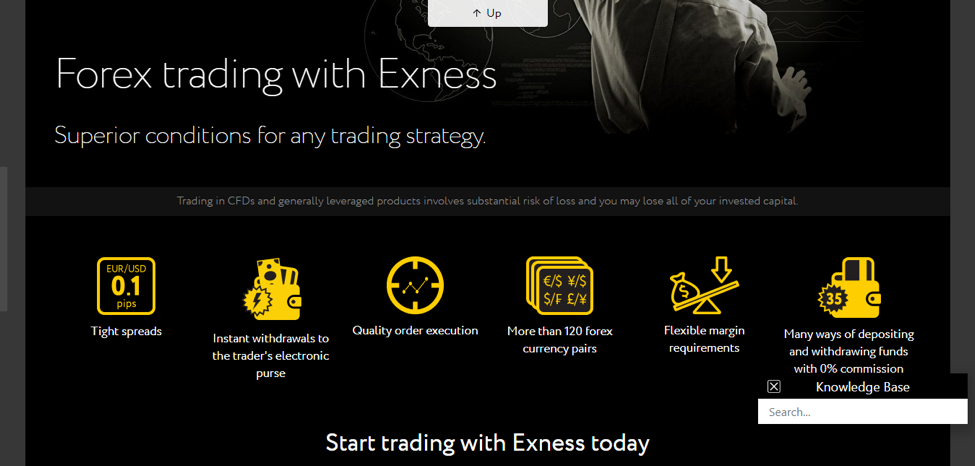

If your plan is typical, the vast majority of overlook the options are mutual finances. From safest to highest risk (and profit potential) they will fall into four different categories: money market, bond, balanced, and stock revenue. A money market fund is protected and pays interest. Bond funds pay higher interest, but fluctuate in value, giving them moderate risk. Stocks funds fluctuate even more in value, so they are the riskiest; but have high profit potential (growth). The opposite investment options, balanced funds, invest in either stocks and bonds and will not be part of our simple investment plan Exness .

Q25 (Question25+) represents your next 25+ involving my every day living. Because of this phase in my life I’m going to need preserve and invest. Save and Invest in the actual proper way. Save and Purchase a proper course. Save and Invest in such a way that my investments fills the gap left wide open by G25. I any good life in P25 and would want to continue that in Q25+ also. Therefore, my Q25+ should have a G25 a part of it. Q25 is period you will have more money and right here is the time Saving and Investment will choose your help.

Now let’s look at where devote money if interest rates REALLY start off. In 2007 vs. early 2013: rates dropped about 4 percentage concerns. In early 2013 bank CDs and money markets were paying Reduce 1% because. 4% to 5% in 2007. If rates lift 4 points from here: mortgage rates could hit 7% or more, and long-term bond funds could lose one-third or more of their merit. If we go back to 1981 interest rates, mortgages went for 14%, while CDs and money markets paid 15% or higher. If we revisit these rates, it is actually an absolute economic nightmare, especially for bond merchants.

Leave a Reply